Why HDB resale flat still attracts COV?

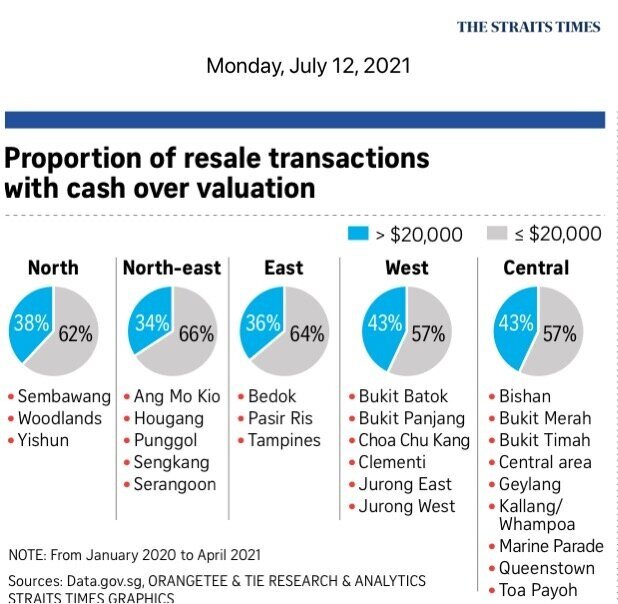

The talk of the town especially with real estate agents serving buyers is how much cash over valuation (cov) expected from each closing? The wait for the valuation report i must say a jittery one not only for buyers but agents as well. I’m not sure how accurate the data from the Straits Times article is as HDB do not publish data on how much cov for each unit transacted but it puts things in perspective.

However, it does gives a sense of the market when it comes to percentage of units transacted that have attracted cov. Based on the charts, a strong indication that an average of 60% resale flats sold, buyers are paying more than $20k cov.

Source : The Straits Times Singapore

What does it mean?

What I can deduce is that demand is still fairly strong amidst a dwindling supply of resale flats. Why i say dwindling is because many fellow real estate agents I spoke to mentioned less appointments for selling and any new listing that comes onto the market, the shelf life is almost non-existent especially if the attributes meets all expectations. Which means units now take a much shorter time to be sold. Which means supply still cannot meet demand in more popular estates.

Most sellers will turn into buyers and they realise that having achieved better than expected or in some cases record breaking prices for their own unit, they now face stiff competition when it’s their turn to find that ideal resale flat. Naturally, as buyers you will be looking for good deals or even no cov. Ironic isn’t it?

As such, many potential or aspiring HDB sellers out there might decide against putting their unit on the market for fear of missing out on units they plan to buy. Simply because many would have to sell first before making that purchase. What if I cannot find the suitable unit for me to buy after selling? Can I back out and not proceed with the sale? These are questions and concerns thrown at me when I go on a listing presentation these days.

Well as much as no one can predict the certainty or otherwise of the desired outcome, we have to take calculated risk when it comes to an upmarket situation. Unless we manage our expectations or look at a different asset class, eg. private property, we have to mitigate the risks with expectations as well as different options.

That is why the HDB market is still buoyant with buyers still willing to fork out high cov in fear of not able to find most suitable unit after selling their current flats.

One way to navigate is to analyse data more thoroughly to see where they are potential opportunities to buy at valuation especially in non mature estates by probably forgoing size and convenience.

Then again, always get opinions of professionals to sieve out the best options for you and your family moving forward.